Real Estate vs. Stock Market: Where to Invest in 2023

Investing can be a daunting task, especially when deciding between real estate and the stock market. Both avenues offer potential for growth, yet they come with their own sets of risks and rewards. In this blog post, we delve into the intricacies of real estate and stock market investments to help you make an informed decision in 2023.

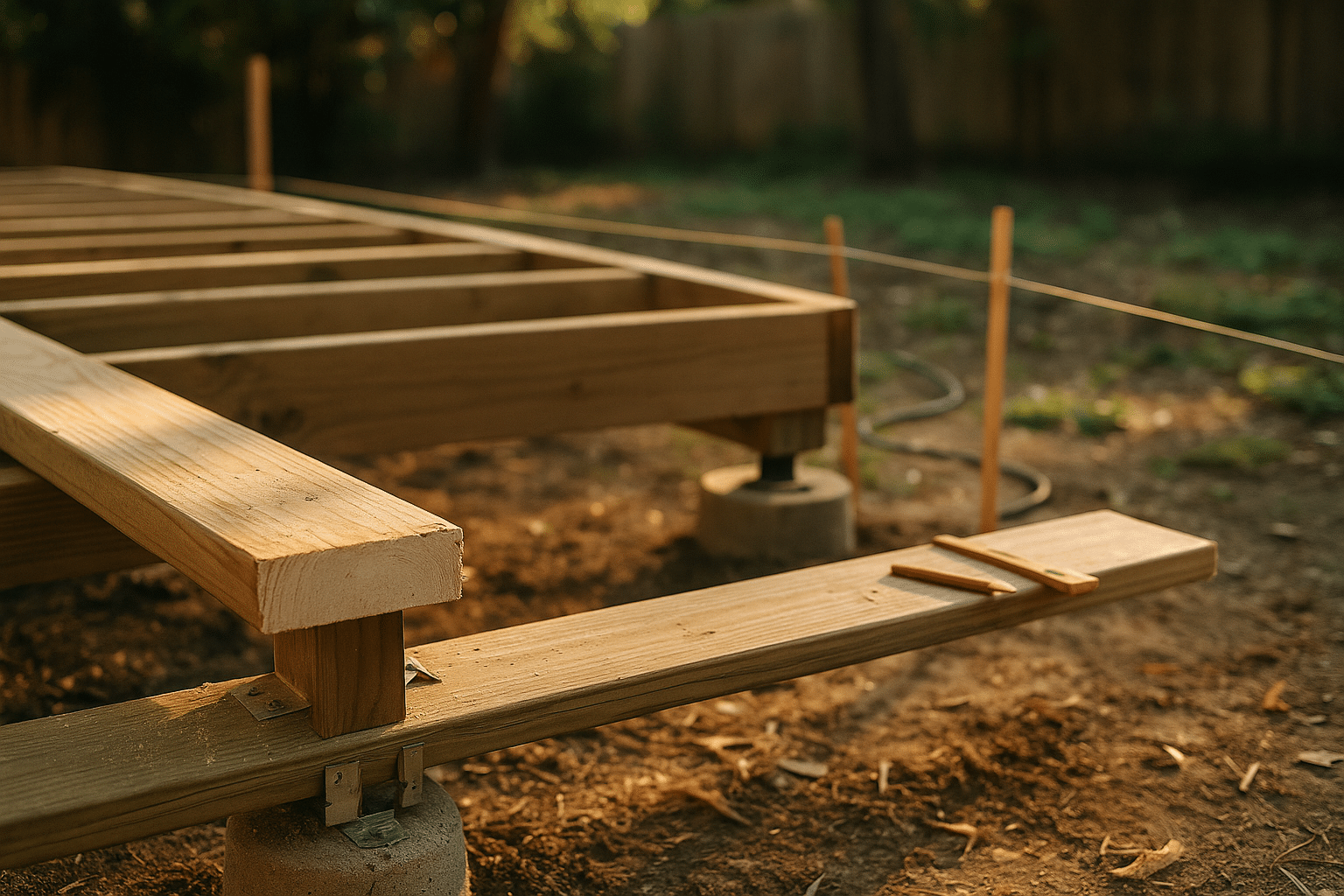

Real Estate: An Investment in Tangibility

Real estate investments often appeal to those who favor tangible assets. According to a survey by the National Association of Realtors, approximately 82% of investors believe that real estate is a safe investment. The allure of property ownership is not just about financial gain; it offers a sense of stability and control.

For instance, consider Alex, who invested in a duplex in a growing neighborhood. Over five years, not only did the property appreciate significantly, but Alex also enjoyed a steady rental income stream. While real estate can provide substantial returns, it requires active management and can be illiquid.

Stock Market: A Gateway to Liquidity and Growth

The stock market, on the other hand, is known for its liquidity and potential for rapid growth. Historically, the S&P 500 has averaged an annual return of about 10% since its inception. However, stocks are subject to market volatility, which can be daunting for some investors.

Consider the case of Jamie, who strategically invested in a diversified mix of tech and health stocks. Despite market fluctuations, Jamie’s portfolio grew substantially, thanks to the compounding effect and timely rebalancing.

Comparing Real Estate and Stock Market Investments

| Criteria | Real Estate | Stock Market |

|---|---|---|

| Liquidity | Low | High |

| Volatility | Moderate | High |

| Control | High | Low |

| Income Potential | Rental Income | Dividends |

| Initial Capital | High | Variable |

| Management | Active | Passive |

| Tax Benefits | Depreciation | Tax-advantaged accounts |

| Appreciation | Moderate | High |

Actionable Tips for 2023

- Assess your risk tolerance and financial goals before choosing an investment path.

- Consider a mixed investment strategy to balance the strengths and weaknesses of each asset class.

- Stay informed about market trends and economic indicators to make timely investment decisions.

FAQs

Is real estate a safer investment than stocks?

Real estate is often perceived as safer due to its tangibility and lower volatility, but it requires more capital and active management.

Can I invest in both real estate and the stock market?

Yes, diversifying your investments across both asset classes can provide balanced growth and risk mitigation.

Conclusion

Deciding between real estate and the stock market ultimately depends on your personal circumstances, risk tolerance, and investment goals. While real estate offers tangible assets and steady income, the stock market provides liquidity and higher growth potential. By understanding the nuances of each, you can create a robust investment strategy for 2023 and beyond. Remember, a well-rounded portfolio often includes a blend of both to capitalize on their respective advantages.